The article below is accurate for your 2017 taxes, the one that you file this year by the April 2018 deadline. Tax information below will change next year for your 2018 taxes under the new tax law effective on your 2018 taxes, but won’t impact you this year. Learn more about tax reform here.

Sometimes even with the best intentions tax filers can overlook legitimate tax deductions that they are entitled to. Let’s help fix that problem.

Below, I’ve shared a few overlooked tax deductions that people miss out on. These overlooked deductions are grouped by family, home, and finally business. Don’t worry about knowing all of these tax deductions and credits, TurboTax will ask simple questions about you and give you the tax deductions and credits you are eligible for based on your answers.

Family

It always starts at home, right? 😉 The good news is that taking care of your family can be a tax benefit come tax time.

- Personal property taxes: You may have received a state and local tax bill during the year for your personal property like a recreational vehicle. While it’s a chunk of change out of your budget, the good news is that state and local property taxes related to personal property is tax deductible.

- Medical expenses: You may be able to claim the amount of your medical expenses that exceeds 7.5% of your adjusted gross income. This tax season, families with new babies may be able to deduct breastfeeding supplies like a breast-pump.

- Charitable contributions: Many of us keep receipts for charitable donations, but did you also include the supplies you’ve spent helping a non-profit organization?

Did any of the tax deductions mentioned above surprised you? When we had our little girl I was happy about breast pumps being included in medical expenses.

Home

We spend so much time at our beloved homes. The roof over our heads can be an even bigger benefit when you consider some of the tax deductions overlooked.

- Moving expenses: If you had to move to a new place due to a job, you may be entitled to a tax deduction for your moving expenses. You have to meet the distance and time guidelines as outlined by the IRS. *Note, 2017 is the last year you can claim your unreimbursed moving expenses under the new tax reform law.

- Refinancing points: If you refinanced your house this past year, you may be able to deduct a portion of your points (it’s spread over the length of the loan). If you have a 15-year mortgage, you can deduct 1/15 of the points each year. Points are pre-paid interest paid to the lender by the borrower to obtain a mortgage loan. This interest can also be called loan origination fees, maximum loan charges, discount points, or loan discounts.

- Casualty-loss deduction: If you’ve been affected by one of the weather-related disasters that happened this past year, you may qualify to get a tax deduction on your loss.

Don’t forget to look at your home mortgage interest you’ve paid as well. It can be a big deduction for some people.

Business

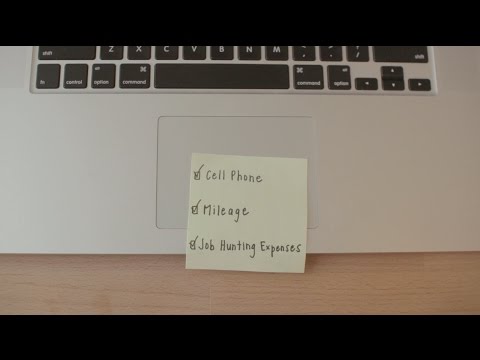

Whether you are looking for work, are self-employed or at a company, there are some tax deductions that you need to be aware of.

- Home office expenses: I was surprised to learn that some entrepreneurs put off including their home office expenses with their tax deductions to ‘be on the safe side’. However, if you’re entitled to it, you should claim it. Make sure you keep an accurate record and you shouldn’t have a problem.

- Cell phones: If you have a cell phone used to handle business matters that bill could be tax deductible.

- Journals and newspapers: Depending on whether or not your subscriptions are job-related, this is another overlooked deduction.

I’d love to hear your thoughts on getting the tax deductions you deserve. How many of you itemized your taxes last year? What deductions did you take? What’s your tax situation this year? Do you qualify for more tax deductions or less?

As you file your taxes this season, if you have questions you can connect live via one-way video to a TurboTax Live CPA or Enrolled Agent to get your tax questions answered. A TurboTax Live CPA or Enrolled Agent can even review, sign, and file your tax return.